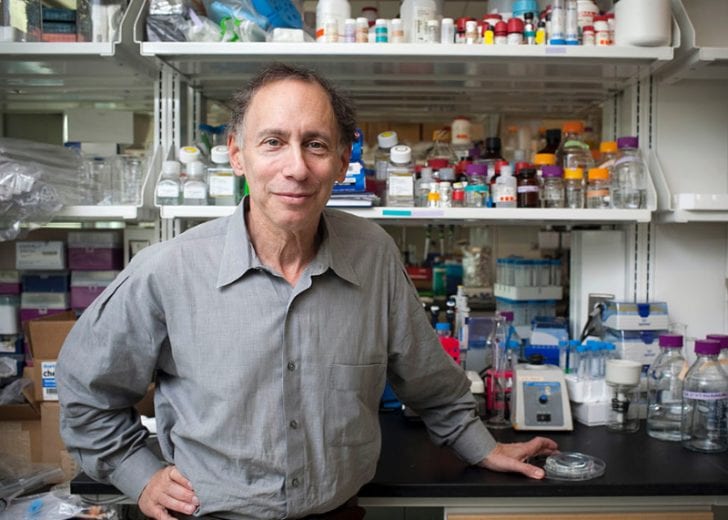

In 1976, Timothy Springer was awarded his Ph.D. degree from Harvard, and his post-doctoral training was with Cambridge, UK’s Dr. Cesar Milstein in. With numerous awards to his credit Dr. Springer is a globally recognized scientist for his contributions in immunology and structural biology. With more than 500 of his peer-reviewed publications which have now gathered over 90,000 citations, Dr. Springer is among one of the highest cited scientists among all fields of science. Timothy Springer’s research laid down the foundation for a new class of pharmaceuticals, the selective adhesion molecule inhibitors, which include approved drugs, such as alefacept, efalizumab and natalizumab. Timothy Springer has always thought his fortune was excessive, even before he became a billionaire.

Dr. Springer’s Investments

An immunologist, Springer is recognized for discovering the first integrins and how these function in the immune system. His pioneering research work laid the roadwork for the development and research of selective adhesion of molecular inhibitors. They are therapeutic antibodies that are utilized for treating autoimmune diseases. Dr. Springer founded the biotechnology company LeukoSite, which was acquired by Millennium Pharmaceuticals for $ 100 million in 1999. LeukoSite developed therapeutics for inflammatory, autoimmune, and cancer applications, including FDA-approved Campath™. Springer has also founded other biotech companies like Scholar Rock and Morphic Therapeutics. The 72-year-old professor first got a break in making millions in 1999, when there was a dot-com bubble. He sold off his first venture called LeukoSite to Millenium Pharmaceuticals for $100M. With these funds, he took out $5 million to invest in Moderna.

About Moderna Inc.

Moderna, Inc. was founded in 2010 (it was called ModeRNA back then), and is based on blueprint research by Derrick Rossi from Harvard University. Rossi studied hoe to play around with mRNA by using human cells. The mRNA is split into stem cells, and then divided into different cell types. Rossi then asked his fellow Harvard co-worker, Dr. Springer, to become the future company’s first investor. He is now the fourth largest investor in Moderna, which is heavily into drug discovery and development and Springer decided to invest $5 million in Moderna, whose IPO was first offered in 2018, and his stake has now become worth more than $1 billion. Moderna Inc., the US biotechnology firm attempts to develop a vaccine for the novel coronavirus. The US Department of Health and Human Services has agreed to pay $438 million to help the company’s efforts in developing the product, which could reach it’d end-stage testing in 2021, if the trials go as planned.

Covid Vaccine Initiatives

The new COVID 19 virus is known to be an RNA virus which belongs to Coronaviridae family and has now caused a global pandemic. This newly sequenced virus originated in People’s Republic of China and rapidly spread across the world, eventually causing over 3.3+ million deaths. Hence, laboratories across the world are working hard to develop an efficient vaccine against this dreaded disease, which will be essential to substantially reduce morbidity and mortality. There are around 70 and more vaccines that are in the various stages of development and testing all over the world, as per the World Health Organization.

Dr. Springer, is among those few to have gained financially from a pandemic that ground the global economy to a halt and which has destroyed over 20 million American jobs.